The U.S. economy is adding jobs rapidly.

March was another strong month for the labor market and the Bureau of Labor Statistics reported 215,000 jobs being added to the economy.

April’s job report is supposed to be a good-looking one as well.

The Federal Funds Rate was raised in December for the first time in nearly 10 years. Back then, the Federal Reserve estimated it would raise rates in each quarter of 2016.

But the start of 2016 has seen sluggish growth primarily as oil flooded the market and its price sank, followed by stocks tanking and fears coming from China as a result.

In March, Fed Chair Janet Yellen indicated there will more likely be two rate hikes this year, not four.

And although it is understandable the most powerful central bank in the world does not want to act when there is an air of uncertainty around global financial markets, it also needs to keep in mind something very important: a looming recession.

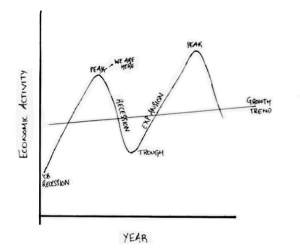

The U.S. is now in its seventh expansionary year. As widely accepted, the period from one economic peak to the next that goes through one recessive trough is considered a business cycle.

And even though the current expansion has not seen GDP grow by a lot, because inflation has been rather flat (but is expected to pick up soon), after the 2008-2009 recession,

things are looking a lot better. In any case, the National Bureau of Economic Research finds the average business cycle to be around six years.

[media-credit name=”SARANG MURTHY” align=”alignnone” width=”300″] [/media-credit]

[/media-credit]

It is safe to say we are at the top of the curve (look at handy hand-drawn illustration), and are looking at an imminent contraction that will see us reach the trough.

After the last recession, the Fed did all it possibly could to see monetary policy work to stabilize the economy.

And for the most part it worked; the economy has recovered.

Quantitative Easing was a quasi-success, but as the Fed Funds Rate, or the benchmark interest rate, had to be slashed in order to encourage more spending, the next recession (granted, it is not going to be as devastating as the last) cannot possibly be met with meaningful rate cuts.

The Fed knows negative rates, like in Japan right now, are a risky game, and if it chooses to boost spending by cutting rates, it needs to raise them first.

The target benchmark rate should mirror the inflation rate, and since the indicators are pointing to inflation catching up with overall growth at about two percent, I strongly believe Chair Yellen should put aside the opinion sections of other nationals that promote a dovish stance from the Fed, pick up the Vermont Cynic, be more hawkish and raise rates in order to effectively cushion the foreseeable recession.

(Graph is not to scale. Average period of expansion: five years. Average period of recession: one year. Average business cycle: From the first peak to the second through of one trough.)