Burlington schools should increase budget

It is an ongoing debate in communities nationwide: increase school budgets — and therefore the quality of education — or lower taxes?

This debate has caused a lot of friction in the Burlington School District.

For example, in 2014, the budget failed because taxpayers were unwilling to accept higher taxes for the proposed increases in spending. This lead to many cuts in school funding and programming and jeopardized the jobs of many teachers and administrators within the district.

Councilor Sharon Bushor said to Seven Days Vermont in January that she will support budget increases, but does not know whether taxpayers will also support the increased taxes that comes along with

it. It always comes down to if taxpayers feel that they can afford to pay.

An increased school budget is important because it contributes to pay raises for teachers and administrators, better transportation and safety and the facilitation of programs, courses, activities and supplies.

These improvements have a direct impact on enhancing the quality of education for students and raising the standard of living for teachers and administrators.

Translation: an increased school budget leads to a better school district all around.

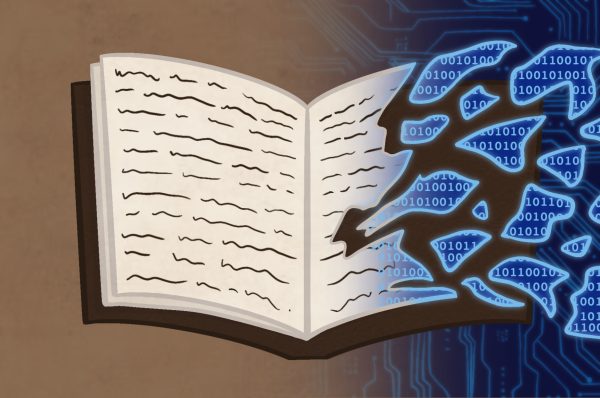

According to The National Education Association, education can be seen as a unique economic industry: schools use resources to produce an output. Therefore, the more you put in, the more you get out. If more money is given

to a school district, then they can attain a higher quantity and quality of resources, and therefore will produce a better output.

What sort of outputs do schools produce?

First and foremost, the goal of schools is to give its students a quality education. If a school district has more resources, it can provide a better education for its students.

Secondly, school districts are a vital component of local economies, and therefore, if they have better resources, they can help produce a better output for the local economy.

For example, people will move to good school districts because those areas are ideal for raising a family. This influx expands the labor force with higher skilled people, who participate in the local economy as business owners and consumers.

Therefore, an increased school budget not only improves the quality of education but also the local economy.

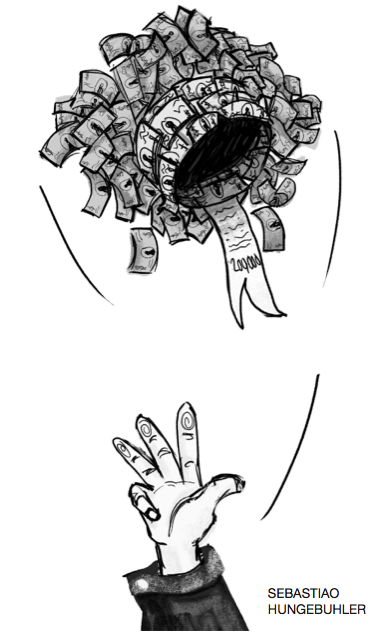

However, as many economists say, “there’s no free lunch.” More funds for schools have to come from somewhere, and that somewhere is taxes.

No one likes taxes.

But there is an important reason why we are taxed: so government can provide society with the services it needs yet can’t attain through the market. Public education is one such service.

Education is vital to providing the generation of tomorrow with the tools it needs to make this world a better place, and sometimes increased taxes are necessary to give public schools the funds they need to accomplish this goal.

This leads to a catch-22: aside from providing a higher quality of education for children, an increased school budget can also sometimes lead to an improved local economy.

However, the increase in taxes necessary to make that sort of school budget possible can also work against improving the local economy.

When households are taxed more, they have less disposable income and therefore can consume less in the local economy.

Hence, the tough decision between more funding for schools or lower taxes.

Voters in the Burlington School District will have to make this decision March 7.

The board has proposed a budget of over $85 million for the 2018 fiscal year, which is almost 7 percent higher than what they are currently spending.

These budget increases reflect a need for more teachers and amenities due to higher enrollment in the Burlington public schools, multilingual classes for the large refugee population and preschool expansion in response to Act 166.

The act was passed by the Vermont Agency of Education in 2014 to expand publicly funded preschool programs.

To accomplish this, however, the board proposes a 5.25 percent increase on property taxes.

Despite this, hopefully the budget passes.

Although the increase in taxes has the potential to decrease the purchasing power of an individual household and therefore decrease some consumer activity in the local economy.

In the long run, the benefits that would be reaped from the additional school programs would far outweigh the costs.

Look at it this way: it is an investment in the future.

Investing in education, as aforementioned, can improve school districts and draw more families to the community, which has the potential to improve the economy.

More importantly, however, better schools improve the lives of children; children today are the doctors, lawyers, environmentalists, and business leaders of tomorrow — it is vital that we invest in their future and give them the education that they need to succeed.