You hear all this chatter about the Federal Reserve doing this and doing that and therefore the markets are “bullish” or “bearish” and so on and so forth. But what do changes in monetary policy really mean to you, the (above) average student?

The effects of changing monetary policy are felt by everyone, whether we know it or not and whether we like it or not.

Before delving into this, a quick definition of monetary policy: the ways in which the Federal Reserve Board of Governors handles the nation’s money supply is known as monetary policy.

Increasing the money supply is expansionary monetary policy, and decreasing it is contractionary monetary policy.

What we are seeing today is essentially the latter; the Fed has decided interest rates have been too low for too long and that the economy is strong enough to continue growing with a little less help from the central bank.

Contractionary monetary policy causes interest rates to rise. A higher interest rate means that domestic bonds (government securities) seem more attractive, and hence their demand goes up.

The demand for the dollar is rising and is relatively high- er than foreign currencies. This higher rate causes exports to decrease and imports to increase.

Good, your econ lesson of the day is complete.

But what are the implications for you? Calling out the biggest elephant in the room is not hard: student loans.

Federal loan borrowers are not going to be affected this academic year, since the interest rates for federal student loans are set in July every year and are tied to the yield on the 10- year treasury bond. Federal loans that are taken out this summer, however, are likely to see a rate increase.

However, private student loans have a variable interest rate attached to them. If your student loan is from a private bank, you are likely to see an immediate effect.

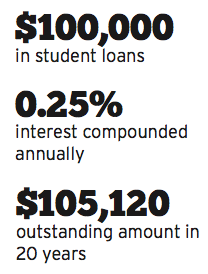

Let me give you a quick example to illustrate the long run total cost of a rate hike: Say you have a $100,000 loan outstanding.

At an interest rate of 0.25 percent compounded annually, in 20 years, the outstanding amount will be $105,120.

That’s a big number, so how am I going to pay back these loans, you ask? Great question! All you need is money. And for money all you need is a job. Or you could win the lottery, but the odds are seriously not in your favor.

The job market, as chief economist at Glassdoor Andrew Chamberlin puts it, (like most things in the macro-economy) is complicated.

It usually takes somewhere between 6 to 18 weeks for the job market to feel the effects of monetary policy – the former is a lagging indicator of the latter.

When the effects are felt, it may be welcomed with a slowdown in hiring, as new loans would seem more expensive to businesses, thus halting expansion.

American products and services will also seem more expensive to foreign buyers, and jobs that are tied to foreign markets may see a setback in job growth.

Therefore, unemployment does rise along with the inter- est rate; but do not worry, the economic cycle is much like the karmic one – what goes around, comes back around.